CIE IGCSE Topical Past Paper 1

4.2 Costs, scale of production and break-even analysis

Table 4.1 Data for one of MHL’s factories | |

Output per month (units) | 200 000 |

Fixed costs per month | $500 000 |

Variable cost per unit | $25 |

(a) Define ‘average cost’.[2]

(b) Calculate total variable cost per month. Show your working. [2]

Working:

Table 2.1 Extract from CTF’s output data (children’s beds per month) | |

Break-even output | 14 000 |

Current level of output | 18 000 |

Maximum factory output | 25 000 |

(b) Calculate the margin of safety for CTF’s children’s beds. Show your working. [2]

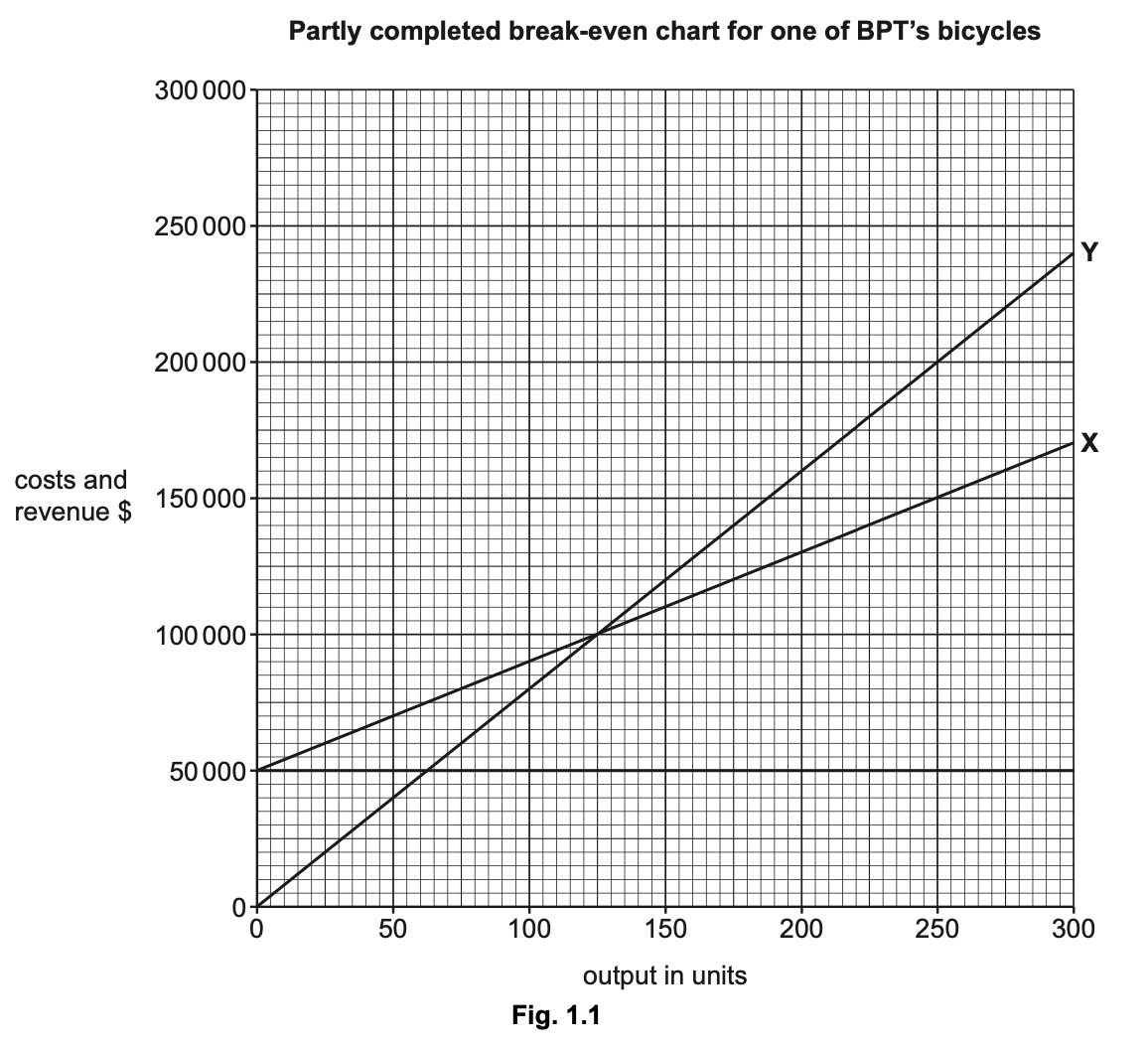

(a) Identify the lines labelled X and Y in Fig. 1.1. [2]

X:

Y:

(c) Outline two ways BPT could lower its break-even level of output.[4]

Way 1:

Way 2:

Table 2.1 Extract from CTF’s output data (children’s beds per month) | |

Break-even output | 14 000 |

Current level of output | 18 000 |

Maximum factory output | 25 000 |

(b) Calculate the margin of safety for CTF’s children’s beds. Show your working. [2]

Extract from FBM’s cost and output data | |

Variable costs per unit | $5000 |

Fixed costs per year | $600 000 |

Number of boats made each year | 300 |

(a) Define ‘diseconomies of scale’. [2]

(b) Identify two ways a business can use cost data to help make decisions. [2]

Way 1:

Way 2:

(c) Identify four fixed costs a business might have. [4]

Fixed cost 1:

Fixed cost 2:

Fixed cost 3:

Fixed cost 4:

Table 2.1 Extract from CTF’s output data (children’s beds per month) | |

Break-even output | 14 000 |

Current level of output | 18 000 |

Maximum factory output | 25 000 |

(b) Calculate the margin of safety for CTF’s children’s beds. Show your working. [2]

Extract from Suliman’s data for his existing business | |

Break-even output | 500 t-shirts |

Current sales | 550 t-shirts |

Selling price per t-shirt | $3.99 |

Variable cost per t-shirt | $1.99 |

(a) Define ‘break-even output’.. [2]

(b) Calculate the margin of safety. Show your working. [2]

Working:

Final answer:

Extract from Paolo’s financial and sales data | |

Average price per cake | $6 |

Average cost per cake | $4 |

Forecast average number of cake sales per day | 50 |

(b) Calculate the average revenue per day. Show your working. [2]